In the heart of India’s agrarian landscape, where over half of the population is occupied in agriculture, lies a persistent challenge: making credit accessible to all. The importance of credit as a critical input to agriculture is reinforced by the unique role of Indian agriculture in the macroeconomic framework and its role in poverty alleviation. Recognizing the importance of the agriculture sector in India’s development, the Government and the Reserve Bank of India (RBI) have played a vital role in creating a broad-based institutional framework for catering to the increasing credit requirements of this sector.

In this context, the need for an affordable, sufficient, and timely supply of institutional credit to agriculture has assumed critical importance. To achieve this, the RBI has introduced Priority Sector Lending targets to allocate funds to predetermined priority sectors of the economy that may require credit and financial assistance. This brings us to the crucial questions surrounding the subject:

What is Priority Sector Lending or PSL?

How is RBI driving financial inclusion for agri-lending in India?

What are the risks associated with Agri-lending?

And more importantly, What is the solution?

Let’s answer these questions comprehensively as we explore them in the following blog. However, before delving deep into the details of the persistent limitations of agri-lending and potential ways to address them, let’s first understand,

What is Priority Sector Lending or PSL?

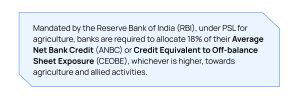

In response to the current credit market of Indian agriculture, the Government of India and lending institutions have embarked on a new journey – A journey to drive financial inclusion, by leveraging technology and innovative initiatives to bridge the gap. At the forefront of this endeavor is Priority Sector Lending (PSL) for agriculture, targeted to be a cornerstone of India’s banking regulations.

For the fiscal year 2023-2024, the PSL target for agriculture was an ambitious Rs 20 lakh crore, highlighting the importance of farmer financing in the nation’s economic agenda. However, the road to agricultural financial inclusion even today, is far from smooth due to the banks and their perceived risks of allocating funds to farmers.

Barriers to Farmer Financing: Banker’s Reluctance

Despite regulatory mandates, bankers often hesitate to extend credit to farmers and stakeholders within the agricultural value chain. This reluctance stems from various factors including:

- Lack of comprehensive data

- Inadequate market linkages

- Uncertainty surrounding periodic waivers by state governments.

With agriculture being susceptible to various risks, from unpredictable weather to pests, the absence of insurance can lead to significant losses for farmers, further wedging the gap between priority sector lending institutions and farmers.

In this case,

Could Technology be the Solution?

Certainly, Technology is a great contender that can catalyze change in farmer financing. It may not address concerns related to loan waivers, but it can effectively tackle other challenges encountered by bankers in farmer financing:

- Through data digitization, technology facilitates the capture of crucial information such as crop health, input utilization, soil quality, market prices, and produce quality.

- The digital transformation enables the assessment of the creditworthiness of farms and farmers, which can be pivotal for risk evaluation, monitoring, and mitigation processes.

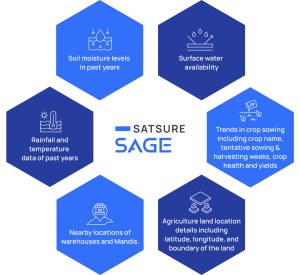

Leading the charge in this technological revolution is SatSure Sage, offering innovative solutions across the different stages of loan lifecycle including:

A Tapestry of Successful Partnerships

Partnership with a Major Indian Private-sector Bank

To illustrate the transformative power of technology in farmer financing, let’s consider the successful tenure of SatSure Sage’s partnership with one of India’s leading Private sector banks since 2018. According to the bank’s Executive Director, they are using the following satellite imagery-derived datasets offered by SatSure Sage:

Leveraging satellite remote sensing, the bank uses these insights to build scoring models for district level, village level, and individual land level to provide an estimate of the past and future agricultural income, the timing of harvest, and sources of income. This data provides key inputs to credit assessments and drives financial inclusion through KCC and non-KCC loans. These insights enable the bank to build scoring models and provide key inputs for credit assessments, unlocking new opportunities for rural borrowers.

Partnership with TransUnion CIBIL

SatSure Sage has also partnered with TransUnion CIBIL (TU CIBIL) to drive the financial inclusion of farmers through better credit underwriting with a combination of credit information from TU CIBIL and agricultural information for region and farm with SatSource Report. The joint product is called The CIBIL Credit and Farm Report (CCFR).

According to the official statement, the MD and CEO of TransUnion CIBIL, Mr. Rajesh Kumar states, “Of India’s 14.6 crore farmers, only 5.7 crore have accessed credit from the formal lending ecosystem. One of the key roadblocks for credit penetration in the agricultural sector is the unavailability of a single, holistic source of information for assessing credit risk and production risk.”

He further added, “Now that the CCFR is making contemporary credit insights along with crop production and production risk parameters available, lenders will have a comprehensive view for astute agricultural credit risk management and policy implementation.”

It’s evident that Satellite imagery and most specifically a holistic and reliable data source, has emerged as a beacon of hope in India’s quest for financial inclusion in agriculture PSL. As innovative solutions evolve with technological leaps and strategic partnerships, the road to unlocking a new era of financial inclusion in agriculture has been laid.

As we embrace this change, it is essential to remember that we are not only contributing to the growth of the modern agricultural economy but building towards empowering a vast industry with inclusivity at the center of it.

Add comment