Banks and financial institutions have long grappled with the challenges of bad loans and rising Non-Performing Assets (NPAs) in agricultural lending. This issue has historically deterred their expansion into rural markets. In response, the government and financial sectors have increasingly leaned on technological solutions to mitigate these risks.

The advent of alternative data-driven technologies in agriculture has ushered in a new era where banks employ sophisticated risk assessment tools to extend credit to farmers. In an agriculture-centric economy like India, alternative data like real-time satellite imagery is transforming how lending institutions identify viable agricultural zones and tailor their offerings strategically to expand their agricultural lending portfolios.

Problems with Traditional Underwriting Practices

Agriculture introduces unique risks not commonly seen in other sectors. Factors such as unpredictable weather, natural disasters, and pest infestations can drastically affect a farmer’s financial stability. Traditional financial models, which are not designed to account for these agricultural variables, often fall short, leading to inadequate risk assessments by banks. Apart from the unpredictability associated with traditional agriculture, aspects such as poor credit history or the lack of credit histories, inability to scientifically track growth and yield and overall instability of income make it a risky sector for investment.

So what is the solution you ask?

Alternative Data to the Rescue

The emergence of alternative data streams has proven to be a game-changer that holds the potential to bridge the data gap and bring transparency and resilience to the agricultural lending landscape.

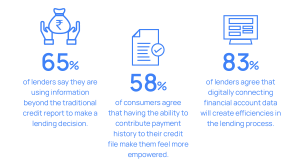

Moreover, alternative data over the past decade has shown great evidence of being a preferred source for confident underwriting, and rightfully so.

Alternative data streams such as satellite imagery, present a promising solution to this challenge. Leveraging satellite data, financial institutions can gain unprecedented visibility into agricultural landscapes, empowering them to make more informed lending decisions and mitigate risk effectively.

SatSure Sage: Empowering Decision-Making Across the Agri Loan Lifecycle

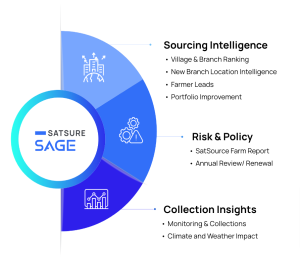

At the forefront of this technological revolution is SatSure Sage, an AI-powered product suite that helps banks and financial institutions make informed decisions across their entire Agri Loan Lifecycle. By combining satellite data and location intelligence, SatSure Sage’s key data products are designed to address critical pain points across the agri-loan lifecycle, from sourcing of leads to collection of loans, with tailored solutions designed to enhance efficiency and reduce risks in agri-lending.

The data products include:

SatSure Sage – Flagship offerings:

Village & Branch Ranking

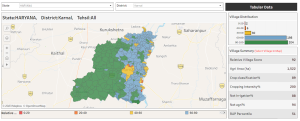

One of the key challenges facing financial institutions is the lack of granular regional data for assessing the risks associated with agriculture loans. SatSure Sage’s Village Ranking tool fills this gap by evaluating and ranking villages based on agricultural performance, climate resilience, and socio-economic indicators. By identifying areas with high agricultural potential and those prone to climate-related risks, financial institutions can optimize their loan-sourcing strategies and prioritize outreach efforts effectively.

Similarly, the bank’s current branches can also be scored and ranked based on the agri potential of all the villages in their catchment area. This will help the banks to identify branches with high agri potential.

Farmer Leads

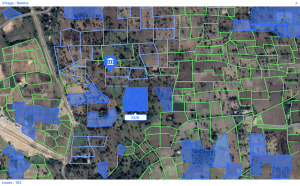

This offering leverages satellite-based analytics to help the banks identify and engage potential borrowers with precision. By analyzing agricultural masks, farm performance metrics, and ownership details, financial institutions can access a steady stream of high-quality leads, thereby streamlining their customer acquisition efforts and maximizing ROI.

SatSource Report for Underwriting

In the realm of underwriting, access to comprehensive and real-time data is paramount for accurate risk assessment. SatSure Sage’s SatSource Report provides credit managers with a holistic view of agricultural land parcels, incorporating historic crop data, ownership records, and real-time earth observation data. Armed with this actionable intelligence, credit managers can make informed lending decisions, minimize default rates, and optimize portfolio performance.

Monitoring and Collection

The solution optimizes agri loan collections by offering real-time insights on crop health, harvest, and early damage detection. This aids banks in allocating high-cost or low-cost resources and engagement strategies with farmers while reducing the need for frequent field visits. By providing continuous monitoring of crop growth and risk at village and plot levels, banks can prioritize collections and maximize loan recovery effectively.

The Vast Potential of Satellite Data for Agri Lending

The integration of satellite imagery into the credit assessment process marks a paradigm shift in agricultural lending. SatSure Sage’s innovative suite of products empowers financial institutions to harness the power of alternative data streams like satellite imagery and AI/ML, unlock unprecedented insights, and drive operational efficiency. This data is rapidly becoming a preferred source of financial institutions as it helps them navigate the complexities of agri-lending with confidence, ensuring sustainable growth and resilience in the ever-evolving agricultural landscape.

Add comment